Employee leasing means that the workers or employees are assigned to work for another company (service recipient) by a leasing corporation, which does not have any formal business activity on the site. Work is performed under the direction and management of the service recipient instead of the foreign employer, and the most tools and supplies are given to the worker by the service recipient as well. However, the employees’ employment contracts are made only with the leasing corporation.

The following sections cover the main regulations and responsibilities of foreign leasing corporations (employer), service recipient companies (which supervises and directs the work) and leased employees considering taxation, legislation and tax treaties.

1. General

2. Employee responsibilities

3. Responsibilities of a service recipient

4. Responsibilities of a foreign leasing corporation (employer)

5. Difference between employee leasing and subcontracting

Personal taxation in international situations is guided by the European law, Finnish legislation and international tax treaties. The wage of a leased employee is subject to tax if they are 183 days or longer during 12 months in Finland, if he/she arrives from a country that has a tax treaty with Finland but is not one of the Nordic or Baltic countries or Belarus, Poland or Turkey (or Bermuda, Cayman Islands, Cyprus, Georgia, Guernsey, Isle of Man, Jersey, Kazakhstan, Moldova, Tajikistan). The wage income is subject to tax starting from the first day in the country, if a leased employee arrives from a country without tax treaty with Finland or from one of the above mentioned countries.

Registration

Before starting to work, the workers arriving in Finland need to visit the local tax office in order to obtain their Finnish personal identity codes and tax numbers. They will need a valid passport together with their employment contract (or employee-leasing contract) covering the main terms and conditions of the employer/employee relationship concerning the work being performed in Finland.

In addition, the employees must register with the local police station no later than three months after arriving in the country if the project takes this long.

Residence permit is not required for EU and comparable nationals. However, non-EU/EEA nationals will need it, unless the work is a temporary subcontract assignment that the employee performs as an employee of a company registered in another country of the EU/EEA, with a permanent employment contract, and with valid residence/work permits in the other EU/EEA country. Work may be done without a residence permit for a maximum of three months.

Reporting

When the employee is tax liable in Finland, he/she will need to file an income tax return to the Tax Administration after every calendar year you having worked in Finland. For this purpose, the employee receives a pre-completed tax return form.

Tax withholding

When the foreign employer of a leased employee does not have a permanent establishment, no subsidiary and no other corporate entity in Finland, it must not collect withholding tax in Finland for the Finnish tax authorities. In this case the employee pays himself income tax on the wages earned in Finland and he/she needs to ask for the tax office to calculate prepayments that will be carried out on a monthly basis by the employee.

Taxation depends on the length of stay and the employee’s home country:

a) When the employee stays less than six months in Finland and is not liable to taxes for this period, the employee will only have to pay the appropriate taxes in the home country.

b) When the employee stays less than six months but is liable to taxes from the first working day (see the conditions in the previous “general” section), the employee must normally pay the 35% flat tax. A person coming from EU/EEA -countries can apply for a lower tax if the salary he received from Finland was at least 75% of his worldwide earned income in the year in question. To facilitate progressive taxation the employee must visit a tax office to ask for a nonresident’s tax card.

c) When the employee stays over six months, he/she will become liable to income taxes. The taxes will be calculated retroactively and therefore it is important to visit the tax office right in the beginning to receive a tax card. The tax card should then be given to the employer/accounting office, when agreed with the employer.

Insurances

When the work lasts for four months or longer, the employee will have to pay health insurance premiums based on his/her gross income, or present an A1/E101 certificate from the home country, indicating he/she belongs to the social security system of his/her home country and should not pay the Finnish health insurance. This applies only to EU/EEA countries. If the employee comes outside EU/EEA for over four months, the employee should pay health insurance premiums.

3. Responsibilities of a service recipient regarding employee leasing arrangements

Reporting

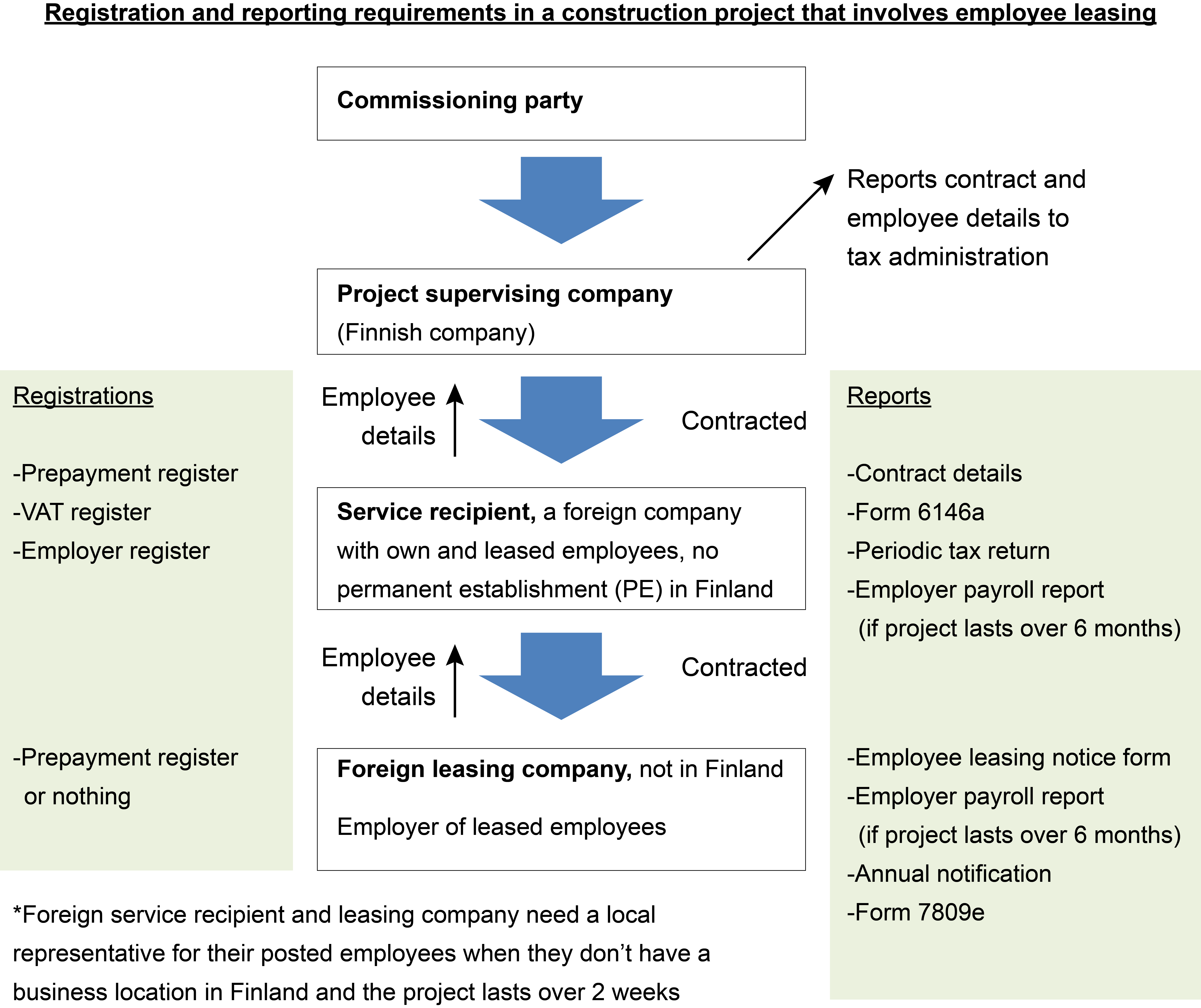

If you are a service recipient leasing workers from other company, you must report the leased employees’ actual foreign employer to the Finnish tax authority. This must be done with the form 6146a the names, addresses, ID numbers and descriptions of the line of business of each leasing corporation are required by the authorities. If you have leased employees from several foreign leasing corporations, use a separate form regarding each leasing corporation. If you signed a contract with an intermediary (not actual employer), you must give the required details on the actual foreign employer for whom your leased employees work and with which they have their employment contracts, not on the intermediary company.

In addition, you must inform the authorities of the representative appointed as provided in the section 4 a of the Posted Workers Act.

Registration

In the minimum, the service recipient must be registered in the prepayment and VAT registers (at least for Notification Duty for supply of services in EU). Therefore, the service recipient needs to report the VAT regularly in respect of its construction-related purchases through periodic tax returns.

If the service recipient also employs people of its own in Finland, then it is also necessary to register as an employer.

Tax withholding

The service recipient is required to withhold 13 percent from payments to foreign corporations or 35 percent to foreign self-employed entrepreneurs as source tax when paying for work performed in Finland, if the foreign corporation is not prepayment registered or have a tax card with a zero withholding rate, or can otherwise prove why the withholding tax should not apply to them.

Other responsibilities

As a buyer of construction and employee leasing services the service recipient is required to file reports on their construction contracts and contractors to the tax administration electronically.

The service recipient needs to collect employee information and report it to the project supervisor or the commissioning party on the construction site. If the service recipient is itself one of these, it is required to report the employee details to the tax authorities electronically.

In addition, although the foreign leasing corporation has the main obligations of an employer, the service recipient receives, by transfer, a set of legal obligations directly connected with work that include adherence to the rules on working hours and occupational safety.

4. Responsibilities of a foreign leasing corporation (employer)

The foreign leasing corporation has the main obligations of an employer as the employees’ employment contracts are made with the foreign leasing corporation, not with the service recipient, and the wages are paid by the foreign leasing corporation.

Reporting

The following reports might be required depending mainly on the length of stay and the country of residence of employees:

1. An employer payroll report (form 7801e) must be sent to the Finnish tax authority at the end of the year by the employer. It covers all necessary annual payroll information including the length of stay and amounts paid to all employees who have worked in Finland and stayed longer than six months. The form should be submitted by a foreign employer, or the employer’s representative, if the employer is not registered in the prepayment register.

2. Employee leasing notice form (form 6147e) is a separate form used to report information on the leased employees in Finland. The report is to be filed separately for each employee.

The leased employee’s foreign employer is required to submit this form, when it does not have a permanent establishment in Finland, and when it is registered in the prepayment register. If the employer is not in the prepayment register, the local representative appointed according to the Posted Workers Act needs to submit the form. The employers with permanent establishments in Finland need not submit the employee leasing notice form because they have the duty to withhold tax on the wages.

3. Annual notification for payments to persons with limited tax liability in Finland should be reported with the form 7809e when applicable. If the employer does not have a local representative, the employer must submit the form himself, regardless of prepayment registration. In case a tax treaty prevents Finland from collecting income tax on the leased employee’s wages, the form 7809e need not be submitted.

If a foreign leasing corporation/employer or its representative fails to submit employer payroll report, a maximum fine of EUR 15000 may have to be paid.

Registration

Foreign leasing corporations must not register themselves in Finland. However, when they lease their employees to work in Finland, they need to have a local representative in Finland according to the Posted Worker Act. In addition, if they are not in the prepayment register or have a tax card with a zero withholding rate, the service recipient that leases employees from them, must withhold 13% tax at source.

Tax withholding

When the foreign employer of a leased employee does not have a permanent establishment, no subsidiary and no other corporate entity in Finland, it must not collect withholding tax in Finland for the Finnish tax authorities. However, in this case the employee pays himself income tax on the wages earned in Finland.

5. Difference between employee leasing and subcontracting

Due to different tax treatment, it is important to differentiate employee leasing from subcontracting. In subcontracting, supervision and direction responsibilities belong to the subcontractor, which is also the employer. In employee leasing, supervision and direction are the responsibility of the service recipient, not the employer.

Furthermore, in subcontracting, tools and equipment are given to the workers by the subcontractor/employer. In employee leasing, the foreign employer does not give tools to the worker, instead, the service recipient gives them. Moreover, the responsibility for the acceptable results of the work lies on the subcontractor, if a subcontracting arrangement has been made. In employee leasing, work results are the responsibility of the service recipient. These details are always verified during the company registration process (Enclosure 6204 to Y1/2 form for the Tax Administration).

If you have any questions, you may contact the writer, Mikko Hirvilammi (MBA Finance): mikko.hirvilammi (at) promolior.com, tel: +358(0)44 2398224.

Other publicationsConnect with us

Contact us

tel. +358 (0)44 2398224

office (at) promolior.com

Promolior Oy

Promolior is a Finnish consulting company specializing in construction business development, financial advisory and compliance services.

We combine industry expertise with automated processes to ensure your construction projects run smoothly.

© Promolior Oy 2015

Promolior Oy

Promolior Oy