This publication discusses the taxation and other provisions that concern Russian based companies and employees in construction and installation projects of different types in Finland, considering the Finnish Income Tax Act, the Finnish-Russian tax treaty and other applicable legislation.

1. Personal Taxation in short-term projects (less than 6 months)

2. Personal Taxation in long-term projects (over 6 months)

3. Health insurance and social security contributions

4. Posted workers

5. Taxation of foreign key employees

6. Taxation of companies and the formation of a permanent establishment

7. Independent contractors

1. Personal Taxation in short-term projects (less than 6 months)

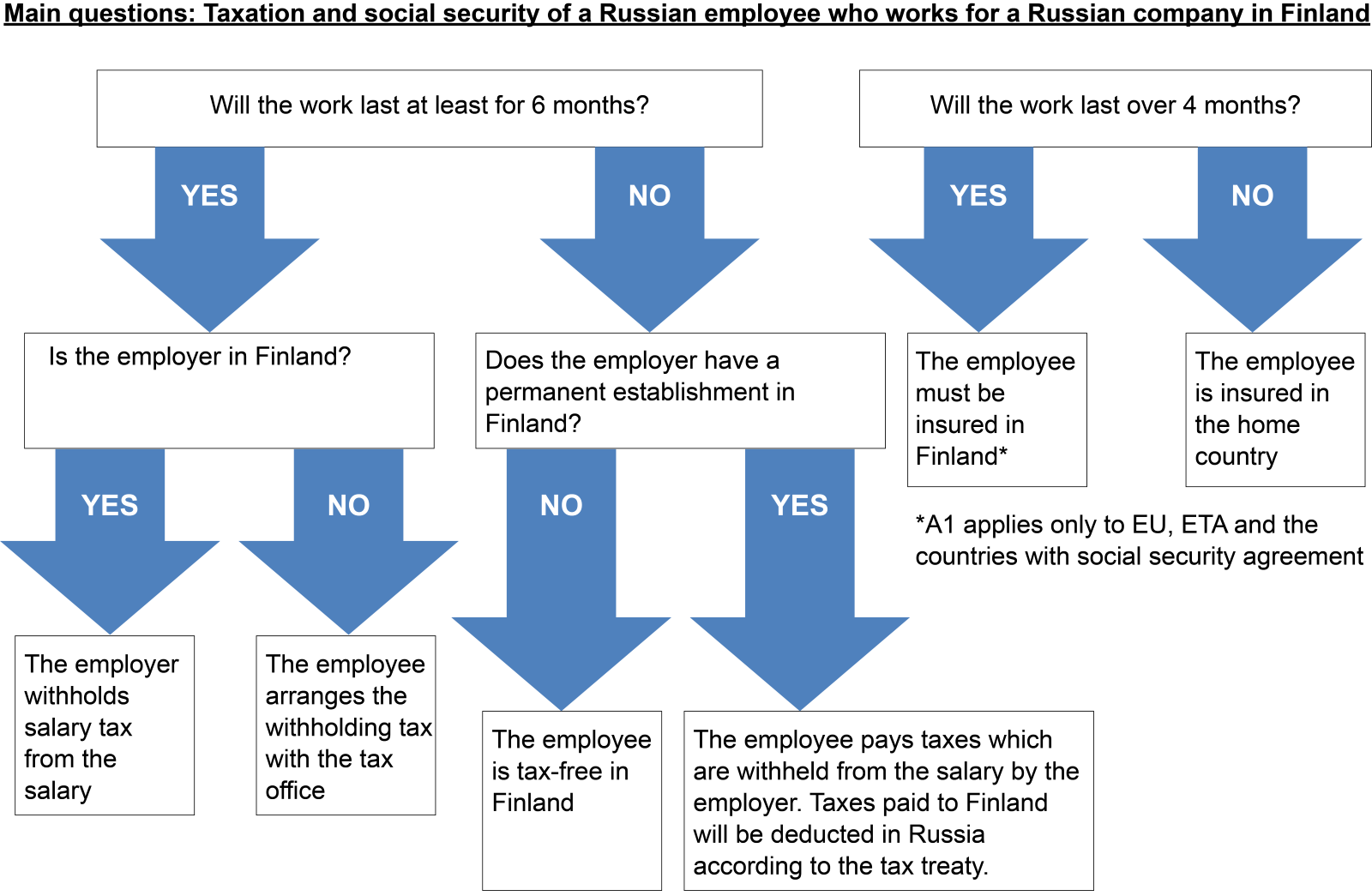

The wage of a Russian employee working in a construction or installation project for a non-Finnish employer is tax-free when the employee stays less than six months in Finland.

The Russian employee will become liable to income tax from the first day in Finland when working for a Finnish company or for a non-Finnish company with a permanent establishment.

Source tax at the 35-percent rate may be applied for the employee working for a Finnish company, which withholds the tax that goes to the Finnish tax authority in total, and which would not need to be reported through yearly tax returns in Finland. In accordance with the Act on the Taxation of Nonresidents’ Income, 510 euros is deducted from the total income before applying the source tax. The employee must present the employer the tax-at-source card to ensure the deduction.

As an alternative to the source taxation, nonresident employees can claim treatment of their earned income under the progressive scheme. Under the progressive scheme, the employee visits a tax office to ask for a nonresident’s tax card, which will then be handed over to the employer.

However, the employee needs to decide which alternative is more favorable in terms of taxation, when all taxable income excluding paid compensation for travel expenses and daily allowance are considered.

2. Personal Taxation in long-term projects (over 6 months)

The employee working over six months in Finland will be tax liable for the income even if the employer is a non-Finnish company and without permanent establishment in Finland. In this case, the employee’s income will be subjected to income tax under the progressive scheme just as the Finnish residents living in Finland on a permanent basis. The company responsible for paying the wage withholds taxes according to the tax card obtained from a tax office. The employer is under the obligation to withhold 60 percent from the wage, if there is no tax card. In addition, the employer must pay the employer’s social security contribution and other insurance contributions based on the wage.

In the situations where it is unclear in the beginning whether the six month period will be exceeded, it is common to withhold first the source tax and ask later on for a nonresident’s tax card, in case the employer is from Finland or has a permanent establishment. The tax card will be granted once it a longer working period has been confirmed.

As an exception to the above, a tax card is not required if the employer is not Finnish, does not have a permanent establishment in Finland, and is not registered in Finland as an employer which means the employer is not obliged to withhold tax from salaries. In this case the employee pays himself income tax on the wages earned in Finland and he/she needs to ask for the tax office to calculate prepayments that will be carried out on a monthly basis by the employee.

In accordance with the provisions of the tax treaty between Finland and Russia, the amount of tax on the income paid in Finland to a Russian resident (persons with limited tax liability in Finland) should be credited by the Russian tax authority against the tax imposed on that resident in Russia.

3. Health insurance and social security contributions

Health insurance premiums will need to be collected in Finland based on the gross income of a Russian employee, when the work lasts for four months or longer.

As a general practice, when the four-month limit is exceeded for an employee from a non-EU country such as Russia, with whom Finland does not have a social security agreement, the employee must be insured according to the laws of both Finland and the employee’s country of residence. Therefore, the employee coming from a country without social security agreement with Finland, must be insured in Finland to cover the work assignment regardless of the length of stay, country of residence, nationality of employer or other factors.

From this standpoint, the situation differs from the employees coming from EU-, ETA- and social security agreement countries, who may be insured only in their home country and demonstrate this by delivering an A1 –certificate.

Russian employee is covered by the Finnish accident insurance with regard to his/her work in Finland even when he/she works for a smaller part of the year in Finland and longer part for example in Russia. Hence, both the employee and employer are liable to pay unemployment insurance premiums as far as the employee and the work carried out in Finland is concerned.

Posted Worker Act applies to all employees posted to Finland regardless of the fact whether the worker’s employer is from within or from outside the European Union.

According to the law, a posted worker is an employee, who normally works in some other country than in Finland, and whose employer, which is a company based in another country, sends the employee to Finland for a limited time period to carry out an assignment in accordance with the agreement made between the employer and a service recipient based in Finland.

If the posted worker’s employer (sending company) has no place of business in Finland, it should have a local representative in Finland, who is authorized and qualified to act before the court and receive official documents on behalf of the company, and who is responsible for maintaining information about the employer’s posted workers. However, there is no need for a local representative if the employees are posted to Finland for 14 days or less.

Posted workers should receive at least a minimum wage in accordance with the applicable collective agreement as required by the law. If the employment contract is in conflict with the collective agreement, the provisions of the collective agreement take preference over the employment contract. The provisions of the Finnish law apply to the employment agreement of a posted worker to the extent that they are more favorable to the worker than the provisions that would otherwise apply.

5. Taxation of foreign key employees

Source tax may be applied to the taxation of a foreign key employee, subject to the condition of specific expertise required for the assignment, monthly wage in the amount of 5800 euros in the minimum and being a tax resident in Finland as soon as the employment begins.

The 35-per-cent flat source tax rate covers all taxes and the Finnish health insurance contribution stipulated by the Finnish Income Tax Act. In addition to the source tax withheld by the employer, the employer pays normal social security, accident, unemployment and pension insurance premiums based on the employee’s wage. The maximum duration for using the source tax is 48 months, after which the employee’s income will be subjected to income tax under the progressive scheme.

6. Taxation of companies and the formation of a permanent establishment

Russian companies have a limited tax liability in Finland and the formation of a permanent establishment (PE) is a decisive factor when considering taxation applicable to their Finnish operations.

In accordance with the tax treaty between Finland and Russia, a permanent establishment is defined as a building site or construction or installation project where activities are carried out longer than 12 months. In addition, a business branch or office or a person in Finland with authority to conclude or sign contracts on behalf of the company, may constitute a permanent establishment.

The company becomes tax liable for its Finnish income once a permanent establishment comes into effect, and must pay income tax at the corporate tax rate of 20% and file a tax return to report the revenues, expenses, assets and liabilities of the PE on a yearly basis. Other obligations include the withholding and payment of non-wage labor costs, employee insurances and arranging accounting of the PE locally in Finland. Therefore, the employee wage costs influence directly on the financial result of the PE.

Planning activities and monitoring carried out in the beginning and end of the construction or installation project are considered part of the project, and the formation of a permanent establishment cannot be avoided by splitting work in shorter periods when it takes over 12 months in total.

According to the tax treaty between Finland and Russia double taxation is eliminated in such a way that the Finnish tax allocated to a permanent establishment will be deducted from the taxation in Russia.

When a company has several independent projects in Finland, they should be considered separately as far as the project duration is concerned and should not be summed together. Furthermore, a permanent establishment will be discontinued after the project has ended or when the suspension of a project or the company’s absence from Finland can no longer be considered temporary.

The financial results and taxation of a permanent establishment are based on the accounting and actual income of the permanent establishment. The costs attributable to a PE of a company are tax deductible in the same way as normal expenses of an independent company. In addition, the common management and administration costs and interests can be shared between the permanent establishment and other parts of the company. Possible losses of the business operations of a PE will be deductible during the ten subsequent tax years.

Independent foreign contractor (may also be called foreign trader or self-employed person) means any natural person who pursues business or professional activities in a self-employed capacity, is based outside Finland and moving temporarily to Finland. The contractor may register a trade name to carry out his/her activities in Finland.

Tax measures imposed on an independent contractor depend on whether the person is considered to be living in Finland and therefore, whether the person has an unlimited or limited tax liability in the country. The tax administration considers a person to live in the country in which he/she has a permanent home and residence. The person will be considered to have an unlimited tax liability also in those cases, when he/she stays in Finland for a continuous period of more than 6 months.

The same rules regarding the formation of permanent establishment apply also to independent contractors, which means that once a permanent establishment exists in Finland, the contractor is tax liable in Finland for all income attributable to the PE. Therefore, the taxable income includes all income from Finland and abroad related to the permanent establishment.

An independent contractor forms the permanent establishment in Finland if he carries out a construction or installation project, whose duration exceeds the time limit of 12 months defined in the tax treaty. The time limit is calculated project-by-project, although in some cases the time used for separated projects on the same construction site may be summed together.

According to the tax treaty between Finland and Russia the income created through business or other similar independent professional activity may be taxed only in the country, in which the person lives as defined in the tax treaty. However, the business activity carried out from the permanent establishment of another tax treaty country (here Russia) that is considered to concern the PE in Finland, may be taxed in Finland.

The duration of a construction project and the formation of a permanent establishment are irrelevant if the independent contractor resides in Finland long enough to be considered to have an unlimited tax liability and living in Finland according to the provisions in the tax treaty. In this case, the Finnish tax authority has the right to tax the person’s income both from Finland and from other countries.

Determining the taxable income of an independent contractor

An independent contractor with limited tax liability is liable to pay taxes on his/her business and professional income related to the permanent establishment in Finland. The capital income of a business entity is taxed at the tax rate of 30% until 40.000 euros, and at 32% for the part exceeding 40.000 euros.

In the situations where there is no permanent establishment or residence in Finland, but grounds for the taxation due to the duration of the contractor’s stay, the source tax of 35% will be imposed on the income.

It should be noted that accrued expenses and interests related to the income generation of a permanent establishment as well as resulted losses from the previous years are tax deductible.

If you have any questions, you may contact the writer, Mikko Hirvilammi (MBA Finance): mikko.hirvilammi (at) promolior.com, tel: +358(0)44 2398224.

Other publicationsConnect with us

Contact us

tel. +358 (0)44 2398224

office (at) promolior.com

Promolior Oy

Promolior is a Finnish consulting company specializing in construction business development, financial advisory and compliance services.

We combine industry expertise with automated processes to ensure your construction projects run smoothly.

© Promolior Oy 2015

Promolior Oy

Promolior Oy